What is debt relief?

Also referred to as debt negotiation and debt settlement, debt relief involves negotiating with your creditors to reduce the amount you owe so you could save money and get out of debt faster.

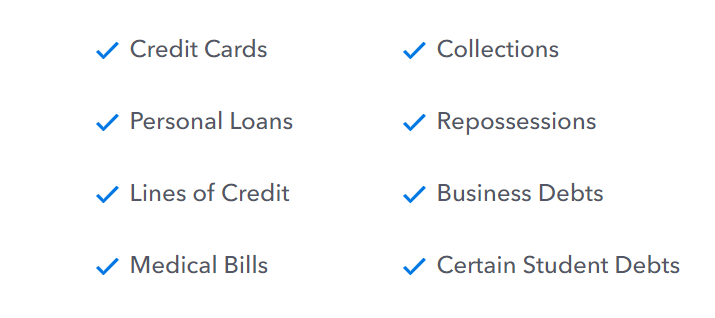

Debt relief isn’t bankruptcy or a loan. It’s a common business practice for resolving unsecured debts, which are debts that don’t require collateral. Our debt negotiation services can help with

What Makes Clear Coast Different?

No Upfront Fees

At Clear Coast Debt Relief, we’re committed to ensuring that we only succeed when our customers succeed. That means you won’t be charged a fee until we deliver results. We are so confident in our ability to successfully reduce your debt that we are willing to work for free until you see significant results.

Negotiating power

Creditors take us seriously because we’ve been negotiating with them for over a decade, resolving thousands of accounts every month. We use our experience and influence to negotiate bigger savings for you.

Our experts are on your side, not the creditors.

-

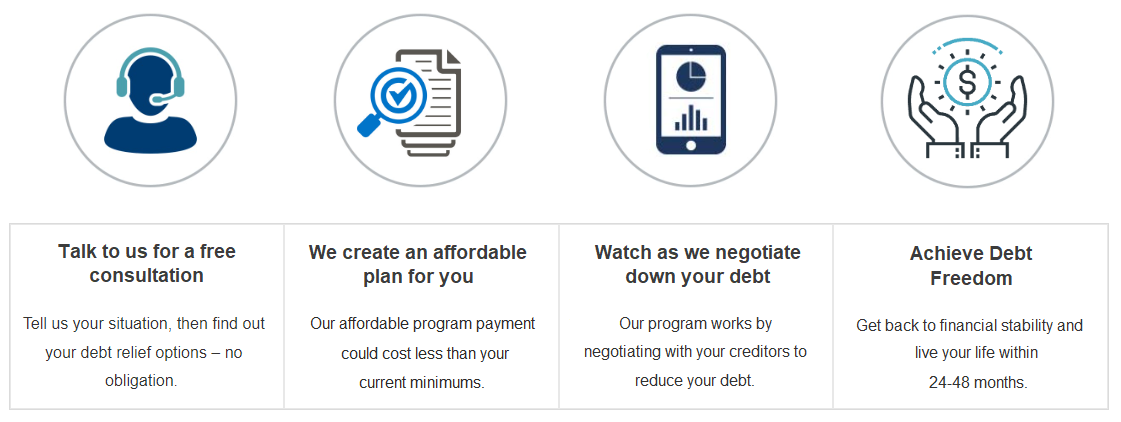

Our Certified Debt Specialists make sure you understand the program. From your first call, you will work with a caring professional who will take the time to understand your situation and create a personalized credit card debt relief plan that fits your budget.

- We provide Expert Negotiators to get you the best terms with your creditors. Our Negotiators have years of experience working with creditors and are highly skilled at debt settlements for the largest savings and in the shortest amount of time.

-

You're Supported by a Customer Loyalty Group that will manage your account and support you along the way. Our Client Relations Specialists are available by phone, email, or chat to answer any questions you have and make sure your account stays on track.

To see how much you could save, call us now: 866-837-0095