8 Credit Score Myths: Why Do Credit Scores Vary?

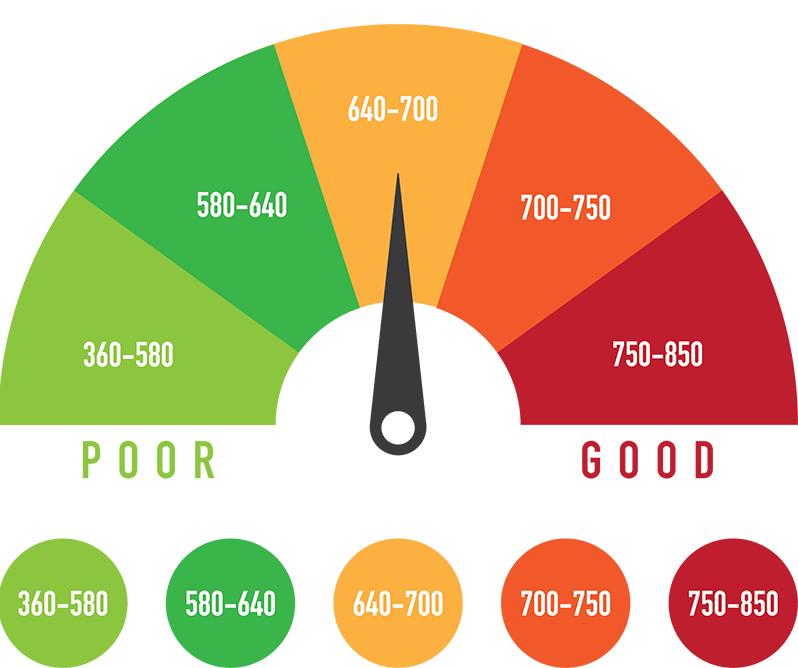

Not all credit scores are the same. Under most scoring models, credit scores (also known as a FICO scores) range from 300 to 850. Anyone taking advantage of the increased access to free credit scores will soon realize that credit scores vary depending on the source. In September 2013 FICO changed its policy and began allowing lenders to share credit scoring data with consumers under their Open Access Program. Prior to this time, credit score information was considered confidential.

With all of this new information available to you, you should be mindful of the following many myths that people tend to believe about their scores.

Myth 1: The Credit Bureaus Decide Whether I Get a Loan

The three credit bureaus, Experian, Equifax, and TransUnion generate credit reports – but they don’t evaluate your credit score or advise lenders whether to approve or deny a loan. The bureaus simply lay out the facts about your credit history – like whether you pay your debts on time. Your actual credit “score” or “rating” is calculated by companies like FICO and VantageScore Solutions, however, these credit bureaus do evaluate your credit risk level based on your credit report.

The credit score company assigns a weight to each piece of data to determine your score. The score evaluates the risk of whether you can take on more debt and if you are likely to pay off the debt. The higher your score the lower the risk to the lender, and the better terms you receive.

Myth 2: There’s Only One Type of Credit Score

It is common for consumers to see one score from the credit card company and then a different score when applying for credit. There are actually many different scores. For example, FICO has several models with varying score ranges that a lender can use. Thus, the FICO score attained by one lender may not be the same score received by another. If a lender declines your application or charges you a higher interest rate because of your score, determine what in your credit history may be negatively impacting your score and work towards resolving those issues. You can request a free copy of your credit report every 12 months from each of the three credit bureaus.

Myth 3: If I Close a Credit Card, its Age is No Longer Factored into My Credit Score

If you’ve got a card that has always been in good standing on your credit report, it might be best to leave it open. As long as the card remains on a credit report, the credit scoring system will continue to see it and still consider the card in the scoring metric—regardless of its age or standing.

Even after an account is closed, a credit card will continue to age and will continue to affect your credit score – whether your account was in good standing or not. However, a closed account will not remain on your credit report forever. The credit bureaus will delete them after 10 years if the account was in good standing, and after 7 years if the account had a damaging history.

Myth 4: I Need to Carry Debt to Build Credit

Not necessarily. It’s all about balance. Making minimum payments and maxing out your credit cards is detrimental to your credit score. It’s also a fast track to needing credit card help. You’re better off having credit cards that are no more than 30% full to show that you can have credit without using it.

Myth 5: Medical Debt is Treated Differently on Credit Reports

Typically, medical bills aren’t reported to a bureau unless the bills are sent to a collection agency. But if the medical bills are reported, credit bureaus treat them the same as other debts. The more recent they are, the more they can affect your credit score.

Myth 6: A Credit Repair Company can only Remove Inaccuracies on my Credit Report

Credit Repair Companies can help provide advice and assistance in reporting inaccurate information on a person’s credit report. If the information on a credit report is negative, but accurate, it’ll take at least 7 years to be removed, no matter how good the Credit Repair company is.

Myth 7: My (Credit) Utilization Ratio Doesn’t Matter

Simply put, your credit utilization is the percentage of your available credit that you’ve actually borrowed. For instance, if your credit card has a limit of $1,000 and you have $250 charged on it, your utilization ratio is $250 out of $1,000, or 25%.

This ratio is a very important piece of the credit scoring system and can seriously affect your credit score in a short period of time – for better or worse. The credit score tracking website CreditKarma.com recommends that consumers shouldn’t exceed utilizing 30% of their available credit. If all your cards are maxed out, you should look into how to pay off credit cards immediately.

Myth 8: I Should Avoid Getting Store Credit Cards Because They’ll Hurt My Score

As long as you use a store credit card responsibly, it can help raise your credit limit, improve your utilization rate, and boost your overall credit score. In fact, it may be a great way to get a credit card for people who might not qualify for other types of cards.

Credit Score Myths Debunked With Clear Coast Debt Relief

Due to variations in credit scoring, you should use one source to track your score over time. Monitor your score when you take out new credit, pay down debt or apply for a loan. Each of these actions will be reflected by changes in your credit score.

Credit scores are used by lenders, insurance companies, utilities, cell phone and satellite companies, and even employers. While credit scoring may not always seem fair, it is critical for consumers to understand as it becomes widely used for decision making processes. Call Clear Coast Debt Relief today for more information!